Is My Foundation Leak Covered?

This tool helps you understand if your foundation leak might be covered by standard homeowners insurance based on the cause and circumstances. Note: This is not a substitute for consulting your insurance agent or policy documents.

Note: This is a general assessment only. Your policy may have specific exclusions or limitations.

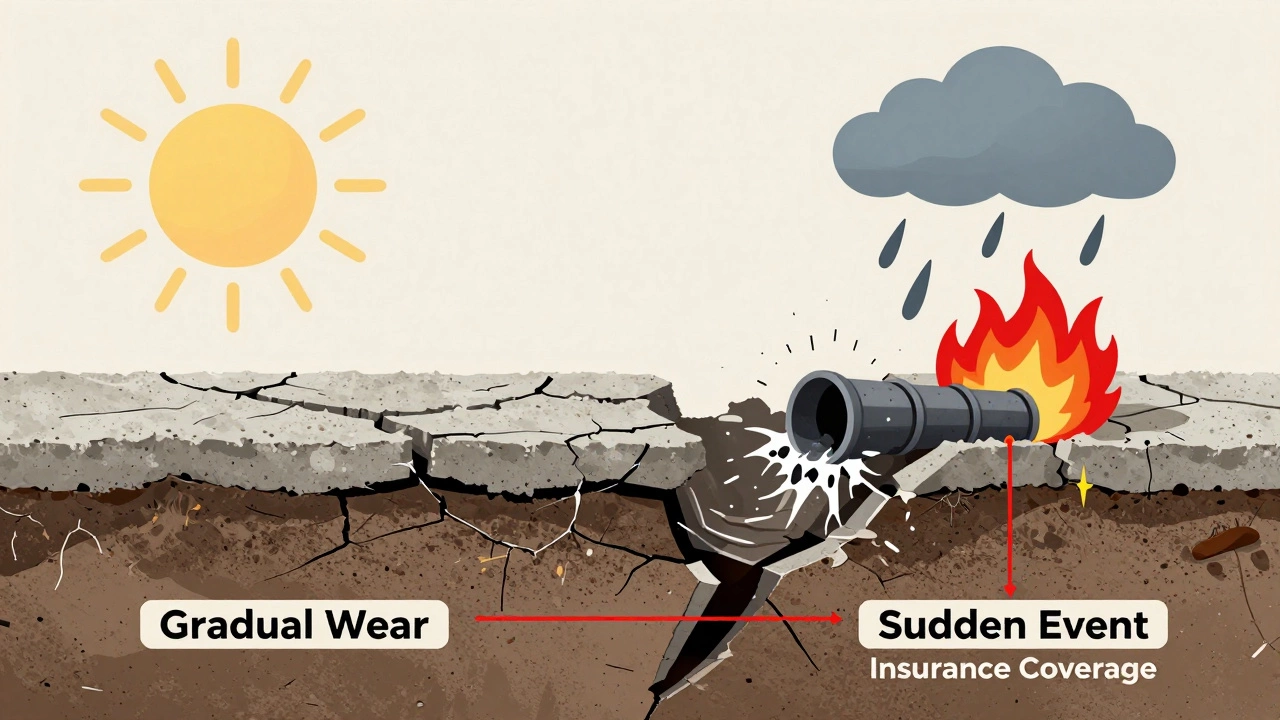

Most people assume their homeowners insurance will cover just about anything that goes wrong with their house. But when a foundation leak shows up-cracks in the basement floor, damp walls, or a musty smell that won’t go away-it’s not always clear if the policy will pay out. The truth? Homeowners insurance rarely covers foundation leaks caused by gradual wear and tear. But it might cover the damage if the leak came from a sudden, accidental event.

What Counts as a Covered Foundation Leak?

Homeowners insurance is built to protect against sudden and accidental damage, not slow deterioration. That’s why a pipe bursting overnight and flooding your basement is likely covered. But a foundation crack that’s been slowly letting water in over six months? That’s a different story.Insurance companies look at the cause, not just the result. If water enters your foundation because of:

- A broken water line inside the house

- A sudden storm that overwhelms your drainage system

- A tree root cracking a sewer line under your slab

-then your policy may cover the resulting water damage to your walls, flooring, or belongings. But if the leak happened because your foundation settled over time due to poor soil, aging concrete, or lack of maintenance, you’re on your own.

Why Gradual Damage Isn’t Covered

Insurance isn’t meant to be a maintenance fund. If your foundation started leaking because the soil beneath it dried out during a long dry spell, or because the original concrete wasn’t mixed right, those are considered preventable issues. Insurance companies call this “gradual damage” or “wear and tear.”Think of it this way: if your roof leaks because shingles wore out after 20 years, you don’t expect your insurer to replace them. Same logic applies to your foundation. You’re expected to maintain your home. That means checking gutters, directing downspouts away from the house, and fixing small cracks before they become big problems.

A 2024 study by the Insurance Information Institute found that over 60% of foundation-related claims were denied because the damage was deemed gradual. In many cases, homeowners didn’t realize the leak had been worsening for months until the drywall cracked or the floor tilted.

When Foundation Leaks Are Covered

There are exceptions. If your foundation leak is the result of a covered peril, your policy might pay for repairs. Here are the most common scenarios where coverage kicks in:- Water damage from a sudden plumbing failure - A burst pipe under your slab causes water to erode the soil under your foundation. The resulting shift is covered.

- Storm damage - A flash flood or extreme rainfall overwhelms your drainage and causes water to pool against the foundation, leading to a crack. If your policy includes flood coverage (separate from standard policies), you may be covered.

- Fire or explosion - If a gas line explosion damages your foundation, that’s covered under standard fire coverage.

- Vandalism - Someone digs near your foundation and breaks a pipe or cracks the concrete. That’s covered.

Important: You need to prove the cause was sudden and accidental. That means having documentation-photos taken when you first noticed the problem, repair receipts, or even a plumber’s report showing the pipe burst suddenly.

Flood Insurance Is Not the Same

Many people assume their homeowners policy covers flooding. It doesn’t. Standard policies exclude damage from rising water, surface runoff, or groundwater seepage. That’s where separate flood insurance comes in.In New Zealand, flood coverage is often bundled with other natural disaster policies, but it’s not automatic. If your foundation leak is caused by heavy rain that turned your street into a river, you need specific flood insurance. Without it, you’ll pay for repairs yourself-even if your foundation cracked from water pressure.

Even if you live on high ground, don’t assume you’re safe. In Wellington, sudden landslides and soil saturation after winter storms have caused foundation damage in areas previously considered low-risk. Check your policy’s fine print. If “surface water” or “groundwater” is listed as an exclusion, you’re not covered.

What About Mold or Structural Damage?

If a foundation leak leads to mold growth, your insurer might cover mold cleanup-but only if it resulted from a covered water event. If the leak was gradual, the mold won’t be covered either.Structural damage to the foundation itself is almost never covered unless it’s caused by a sudden, insured event. For example: if a tree falls on your house and crushes part of the foundation, the structural repair is covered. But if your foundation settles because of poor drainage over years? That’s excluded.

Some policies offer limited “sudden and accidental structural damage” coverage, but these are rare and often come with low limits. Don’t assume you have it. Ask your agent for a written copy of your policy’s exclusions.

How to Prove Your Leak Was Sudden

If you believe your foundation leak was caused by a covered event, you need to act fast-and document everything.- Take clear, dated photos of the leak and any visible damage.

- Call a licensed plumber or structural engineer for an inspection. Get a written report that states the cause (e.g., “burst copper pipe under slab” or “sudden pipe failure”).

- Keep all receipts for temporary repairs, like water extraction or boarding up walls.

- File your claim within 30 days. Most policies require prompt reporting.

Insurance adjusters will look for signs of long-term exposure: rust on pipes, yellowing drywall, or cracked tiles that show wear patterns. If they see those, they’ll likely deny the claim. The more evidence you have that the leak was sudden, the better your chances.

What You Can Do to Avoid Denial

Prevention is your best insurance. Here’s how to reduce the risk of a denied claim:- Check your gutters and downspouts twice a year. Make sure water flows at least 6 feet away from your foundation.

- Install a sump pump if you’re in a low-lying area or have a basement.

- Get your foundation inspected every 3-5 years, especially if your home is over 20 years old.

- Fix small cracks in concrete or brick as soon as you see them. A $50 sealant job now can save you $10,000 later.

- Know your policy’s exclusions. Ask your insurer for a copy of the “General Exclusions” section.

Many homeowners don’t realize their policy has a “maintenance exclusion” clause until it’s too late. Don’t wait for disaster to read the fine print.

What If Your Claim Is Denied?

If your claim is denied because the insurer says the leak was gradual, you have options:- Request a second opinion from an independent structural engineer. Sometimes, a different expert can identify a sudden cause the adjuster missed.

- Review your policy again. Look for any language about “hidden damage” or “latent defects.” Some policies cover damage that wasn’t visible until it became severe.

- File a complaint with your country’s insurance ombudsman. In New Zealand, that’s the Financial Services Complaints Limited (FSCL). They can review your case for free.

Don’t accept a denial without pushing back. Many claims are overturned on appeal when new evidence is presented.

Should You Buy Extra Coverage?

Standard policies won’t cover foundation repair from settling, soil movement, or aging. But there are add-ons:- Foundation coverage endorsement - Some insurers offer this as an optional add-on. It covers repair costs for cracks or shifts due to soil movement, but usually excludes pre-existing conditions.

- Home warranty plans - These aren’t insurance, but they can cover plumbing and structural components. Read the fine print: many exclude foundation work unless it’s tied to a covered system like plumbing.

These add-ons cost extra-often $100-$300 a year-but they can be worth it if you live in an area with clay soil, frequent earthquakes, or heavy rainfall. In Wellington, where soil shifts are common, it’s a smart investment for homes over 15 years old.

Final Takeaway

Homeowners insurance doesn’t cover foundation leaks caused by age, poor drainage, or soil movement. But it might cover the damage if the leak came from a sudden, unexpected event like a burst pipe or storm surge. Your best defense? Regular maintenance, early detection, and knowing exactly what your policy does-and doesn’t-cover.If you notice water near your foundation, don’t wait. Take photos, call a professional, and check your policy today. A small fix now could save you from a massive, uncovered repair later.

Does homeowners insurance cover foundation repair?

Homeowners insurance only covers foundation repair if the damage was caused by a sudden, covered event like a burst pipe, fire, or storm. It does not cover repairs due to gradual settling, soil movement, or aging materials.

Is water damage from a leaking foundation covered?

Water damage from a foundation leak is covered only if the leak resulted from a sudden, accidental event like a burst pipe. If the water entered slowly over time due to poor drainage or cracked concrete, it’s excluded.

Does flood insurance cover foundation leaks?

Flood insurance covers damage from rising water or surface flooding, but not damage caused by groundwater seepage or slow leaks into the foundation. If water enters your basement because the ground is saturated, you’re covered. If it seeps through a crack you ignored for months, you’re not.

What should I do if I notice a foundation leak?

Take immediate photos, turn off water if it’s from a pipe, and call a licensed plumber or structural engineer. Get a written report identifying the cause. Then contact your insurer within 30 days. Delaying can lead to claim denial.

Can I add foundation coverage to my policy?

Yes, some insurers offer a foundation coverage endorsement as an add-on. It typically covers damage from soil movement or settling but excludes pre-existing conditions. Ask your provider about availability and cost.

Author

Damon Blackwood

I'm a seasoned consultant in the services industry, focusing primarily on project management and operational efficiency. I have a passion for writing about construction trends, exploring innovative techniques, and the impact of technology on traditional building practices. My work involves collaborating with construction firms to optimize their operations, ensuring they meet the industry's evolving demands. Through my writing, I aim to educate and inspire professionals in the construction field, sharing valuable insights and practical advice to enhance their projects.